TFF ThinkTank | The Impact of Reduced Child Tax Credit in the United States

- TFF Admin

- Oct 16, 2024

- 5 min read

by Zheng Jia Yi

The Forbidden Flourish

October 11, 2024 09:00 USA

Introduction

The Child Tax Credit was first introduced in 1997, providing a non-refundable credit of $500 per child under 17 for eligible families. This amount was later increased to $1,000 in 2001, $2,000 in 2017, and $3,600 in 2021 as part of the American Rescue Plan Act. President Reagan praised this policy as the best anti-poverty, pro-family, and job creation measure passed by Congress.

Some critics argue that this measure redistributes income to people who have never paid a penny in taxes but receive subsidies from the government (Hungerford & Thiess, 2013). In 2022, amid increasing government budget deficit pressures, the enhanced provisions in the American Rescue Plan Act (ARPA) ended, reducing the credit to $2,000 per eligible child. It is expected that by 2025, the U.S. federal child tax credit will be reduced to $1,000 per child. From a macroeconomic perspective, this may help alleviate the government's financial pressures. However, for families with children, the impact will be more severe and may harm the educational quality and growth environment of children in poor families. This article will analyze the micro and macroeconomic impacts of this policy change, using arguments and statistical data to support the conclusions.

Main Body

First, let's look at the current economic situation in the United States. Since early 2021, the U.S. and other major Western economies have faced record-high inflation rates, especially after the start of the Russia-Ukraine conflict. This has greatly increased the cost of living in the U.S., with prices of energy, food, and other basic commodities reaching unprecedented levels. However, during this period, the U.S. labor market remained strong, with the unemployment rate falling from a peak of 14.7% in 2020 to 3.5% in July 2022 (Mutikani, 2023), close to the frictional unemployment level. To combat high inflation, the Federal Reserve has raised interest rates at a record pace since early 2022, far above the near-zero levels of 2020/21, shifting from monetary easing to monetary tightening policies.

From a macroeconomic perspective, such a policy change will help improve the government's fiscal situation by reducing public spending and increasing net tax revenue, thus easing the burden of national debt service costs. For example, according to estimates from the Tax Foundation's general equilibrium model, making the expanded child tax credit in the American Rescue Plan Act (ARPA) permanent would cost about $1.6 trillion over a 10-year budget window. White House data shows that nearly 40 million families currently apply for the Child Tax Credit (CTC), meaning that reducing the CTC from $2,000 to $1,000 could save nearly $40 billion annually. These additional savings could allow the U.S. government to fund other important programs, such as subsidizing corporate investment in green energy transition, or further investing in other supply-side policies that directly benefit working families. Finally, this policy change can serve as another tool to fight inflation, albeit at a considerable cost.

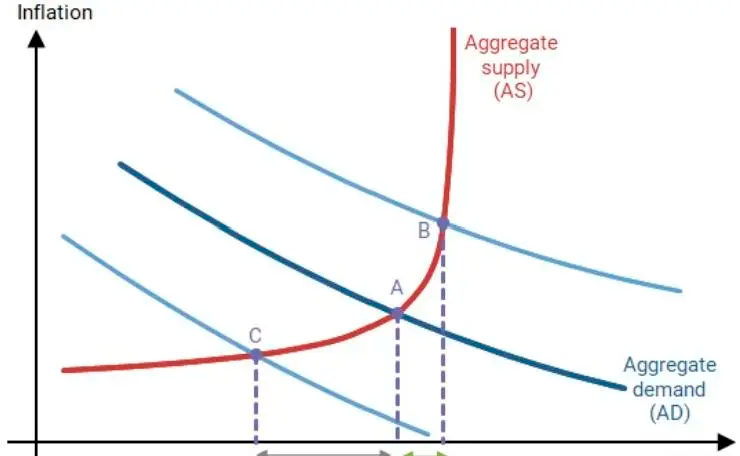

As the child tax credit reduction is a fiscal tightening policy, benefiting from the multiplier effect, the decrease in CTC spending will lead to a decline in household consumption, which in turn reduces corporate profits (and thus investment). Research from the Federal Reserve Bank of San Francisco (Barnichon et al., 2021) shows that the effects of fiscal spending cuts have a higher negative impact ratio than fiscal spending increases of the same scale. The researchers set the fiscal tightening multiplier at 1.4, while the fiscal expansion multiplier is 0.8.

As shown in the figure, the CTC reduction would be a contractionary policy, potentially leading to an evolution from point A to point C. The price level will decrease, and GDP will significantly reduce. The result is twofold: the decrease in output will naturally suppress inflation, helping households cope with daily expenses; however, it also means that more families in low-income jobs will face the risk of unemployment. Therefore, without other forms of increased public spending, the CTC reduction alone would pose greater challenges for American families and inhibit economic growth in the short term.

From a microeconomic perspective, if the government reduces the child tax credit, it will undoubtedly negatively impact families with children, especially during the current high inflation period when daily expenses occupy a larger portion of family income and savings. The reduction in child tax credit means a direct decrease in disposable income for families with children. The increase in child tax credit during the 2021 American Rescue Plan period led to historically low child poverty rates - including historically low poverty rates for Black and Hispanic children (US White House, 2022), further highlighting the disproportionate impact of policy changes on families in poorer communities. Moreover, reducing CTC will have long-term income and gender inequality implications. According to a 2023 report, childcare costs in the U.S. have skyrocketed by over 220% since 1990 (compared to an inflation rate of 138% during the same period) (Raiken, 2023).

Therefore, reducing CTC will not only affect families living near the poverty line but will also severely impact single-mother families. These two groups may find it difficult to provide basic necessities and will have less time to care for their children. This could lead to children from these families having lower future income potential than their peers due to poorer education and care. This intergenerational impact should be a focus of concern for communities hoping to break the cycle of intergenerational inequality.

Conclusion

In conclusion, while from an economic perspective, this policy may help alleviate the U.S. government's debt burden and reduce high inflationary pressures, its negative impacts will far outweigh its benefits for families hoping to support their children's growth. The final judgment on this policy change should depend on where the saved tax revenue will be used. However, assuming this policy change is merely a reduction in fiscal spending, reducing CTC would be a mistake in the context of exacerbating wealth and income inequality and global efforts to address gender inequality. Today's increasingly competitive educational and employment opportunities demand better training and teaching - cutting CTC could disadvantage millions of children for generations to come. In fact, we can propose several solutions to avoid this policy mistake. One is to reduce federal defense spending - U.S. defense spending exceeds that of the rest of the world combined. A small cut in the defense budget could save an amount equivalent to (or even more than) the CTC reduction. Another solution is to close tax loopholes and ensure that the wealthy and the top 1% pay their fair share of taxes. Current and past governments have struggled with this, but if truly committed to breaking intergenerational inequality, CTC reduction should not be implemented, and other solutions should be sought, depending on policymakers' priorities.

References

1. Hungerford, T. L., & Thiess, R. (2013). The earned income tax credit and the child tax credit. Economic Policy Institute Issue Brief, 370, 1-16.

2.Mutikani, L. (2023, August 4). US job growth slowing, but wage gains remainstrong.Reuters.https://www.reuters.com/markets/us/us-job-growth-remains-moderate-july-wage- gains-still-strong-2023-08-04/

3.US White House (2022, March 8). FACT SHEET: State-by-State Analysis of American Rescue Plan Tax Credits for Families and Workers. White House.https://www.whitehouse.gov/briefingroom/statementsreleases/2022/

4. Raiken, A. (2023, June 15). Childcare costs have gone up by 220% in the US since 1990, a new report finds. Independent. https://www.indep-endent.c-o.uk/life-style/

5.Barnichon, Regis, Davide Debortoli, and Christian Matthes. "Can Government Spending Help to Escape Recessions?." FRBSF Economic Letter 2021.02 (2021): 01-05.

Comments